Corporate leaders need to have a plan, regularly exercise it, and understand the limitations of their duty of care provider and insurance platforms.

The COVID-19 pandemic, increasingly destructive natural disasters, and an uptick in regional conflicts, most recently Russia’s war in Ukraine, underscore the importance of corporate leaders planning for a crisis with the goal of minimizing disruptions to their business operations when their supply chains have been impacted. The question then is: How can corporate leaders better protect their businesses and people in the face of these disruptions?

Global Guardian hosted a webinar on April 6 in which panelists discussed the limitations of insurance plans, duty of care, and emergency assistance providers during a crisis, and outlined best practices for developing and exercising emergency response plans.

The conflict in Ukraine “has reminded us of the need to review our respective duty of care policies and ensure emergency response plans are serviceable and comprehensive,” said Global Guardian Chief Operating Officer Mark Post, who moderated the discussion. The panelists included Alfred Bergbauer, head of multinational, captives, programs and third-party administrator services (middle and large commercial) at The Hartford, a U.S.-based investment and insurance company; and Global Guardian Chief Executive Officer and President Dale Buckner.

Globalization and an Interconnected World

What the Hartford’s clients have in common is “a global nature of risk and interconnected supply chain system,” according to Bergbauer. Using the example of a client that manufactures backpacks, Bergbauer described the intricate, multi-country supply chain that supports this business. A backpack is a relatively simple product, Bergbauer noted, “but a fair percentage of the world is involved” in its manufacture.

Emphasizing the importance of companies preparing for worst-case scenarios in a world where disruptions are becoming all too common, Bergbauer said the backpack manufacturer, for example, has “two to three levels deep of replacement products if a subcomponent manufacturer or supplier broke down.” He added: “As an insurer, we were quite happy to put our balance sheet at risk for these people because in the event of a crisis they know what they are going to do” to keep the process of manufacturing going.

Global supply chains reveal the interdependence and interconnectedness among countries. Growing nationalism, not just in the United States but also in other parts of the world, “works in direct conflict with the reality of how connected we are with supply chains and this cross-border interplay of getting even a simple product like a backpack to market,” Bergbauer said. Even if U.S. manufacturers wanted to have all their operations in the United States, they probably couldn’t, he added.

Growing nationalism, not just in the United States but also in other parts of the world, “works in direct conflict with the reality of how connected we are with supply chains and this cross-border interplay of getting even a simple product like a backpack to market,” Bergbauer said.

Buckner agreed. “This concept that we are going to fold up shop and bring everything back to the U.S., I don’t think is realistic,” he said. It is, therefore, important that companies take a close look at the durability of their existing supply chains, he added.

Supply Chain Disruptions Are Becoming More Common

The COVID-19 pandemic severely impacted global supply chains. Early in the pandemic, 75 percent of U.S. companies experienced some form of supply chain disruption; 57 percent of firms experienced longer lead times to get their products completed; there was a 220 percent increase in China-based supplier lead times, a strain that is being felt once again with the current spike in COVID-19 infections in China; and 44 percent of U.S. companies surveyed by the Hartford had no active plan to address the disruption from China alone, according to Bergbauer. “It really puts a sharp point on the notion of planning,” he added.

“When 44 percent of corporate America does not have a backup [plan] with China alone, we clearly have an issue,” said Buckner.

Buckner predicted that the war in Ukraine will have long-term consequences for global supply chains. Bergbauer agreed that the war has exacerbated existing supply chain challenges, and, he added, companies are also struggling with labor shortages; rising costs of products, labor, and delivery; and hoarding by suppliers. “It’s just a cascade of cost implications,” Bergbauer said.

As a consequence of current disruptions, companies are likely no longer going to “blindly build up operations in countries that may not have their best interests in mind,” Bergbauer said. He believes corporate leaders will be much more thoughtful about where they place their operations and who their local, national, and international partners are. He suggested corporate leaders reach out to their insurance brokers to help them navigate this complex terrain and learn how to protect their assets.

Tips for Surviving a Crisis

Bergbauer and Buckner listed some actionable steps companies can take to manage their brand during a crisis. “These are things that allow brands to survive, and even thrive, during a crisis,” Bergbauer said.

1 |

Elevate your capacity to manage a crisisReview how your company will respond to a crisis, and who will lead that response, even before it occurs. |

2 |

Build muscle memory through trainingBoth Bergbauer and Buckner emphasized the importance of not just having a crisis response plan, but also exercising it regularly. They recommended tabletop exercises and practicing what-if or worst-case scenarios. Companies need to train their employees to manage interactions with people. Who is going to do what when, Bergbauer asked, suggesting mock events to build muscle memory so employees know how to act during a crisis. |

3 |

Have a backup plan to avoid business disruptionsCompanies should understand the strengths and weaknesses of their suppliers and distributors and develop backup plans in the event they are impacted during a crisis. |

4 |

Ensure quality controlCompanies should be attentive to quality control as they consider backup plans for when supply chain disruptions might occur, said Bergbauer. “If you take inferior products from a supplier, it can cause further disruption,” he said. He recommended companies also examine their recall procedures and ensure that they have a call center and/or website in place that can manage a large volume of inquiries in the event of a product recall. |

5 |

Break down internal organizational silos“Firms that are stovepiped almost always fail,” Buckner said. He said corporate leaders need to shift their mentality. “You should expect massive supply chain disruptions, massive disruptions by natural disasters and conflict around the world. If that’s not your mindset, you are already behind before [the crisis] even starts,” he said. |

An Age of Disruptions

Buckner noted that while at the start of the pandemic a lot of regional conflicts “went to ground… those conflicts have come back.” Besides conflicts, he noted a global spike in cybersecurity incidents, including a 133 percent increase in cyberattacks originating in China on U.S. corporations. Further, he added, natural disasters have turned more frequent and destructive, the pandemic continues helped along by variants of the coronavirus and low vaccination rates in some parts of the world, and violent crime is soaring.

“Almost every year there is a major disruptive event,” said Buckner. “We are almost guaranteed with a 100 percent certainty that we will have another disruption in the next six to eight months. Then the question is: Are the lessons learned of the last decade in frequency, violence, and disruption actually making a difference at your corporate headquarters? Have you really made changes with your insurance and your duty of care provider? And do you really understand their capability of what they will and will not do in a natural disaster, terrorist attack, warzone, or conflict?”

“We are almost guaranteed with a 100 percent certainty that we will have another disruption in the next six to eight months. Then the question is: Are the lessons learned of the last decade in frequency, violence, and disruption actually making a difference at your corporate headquarters?

Crisis Commonality

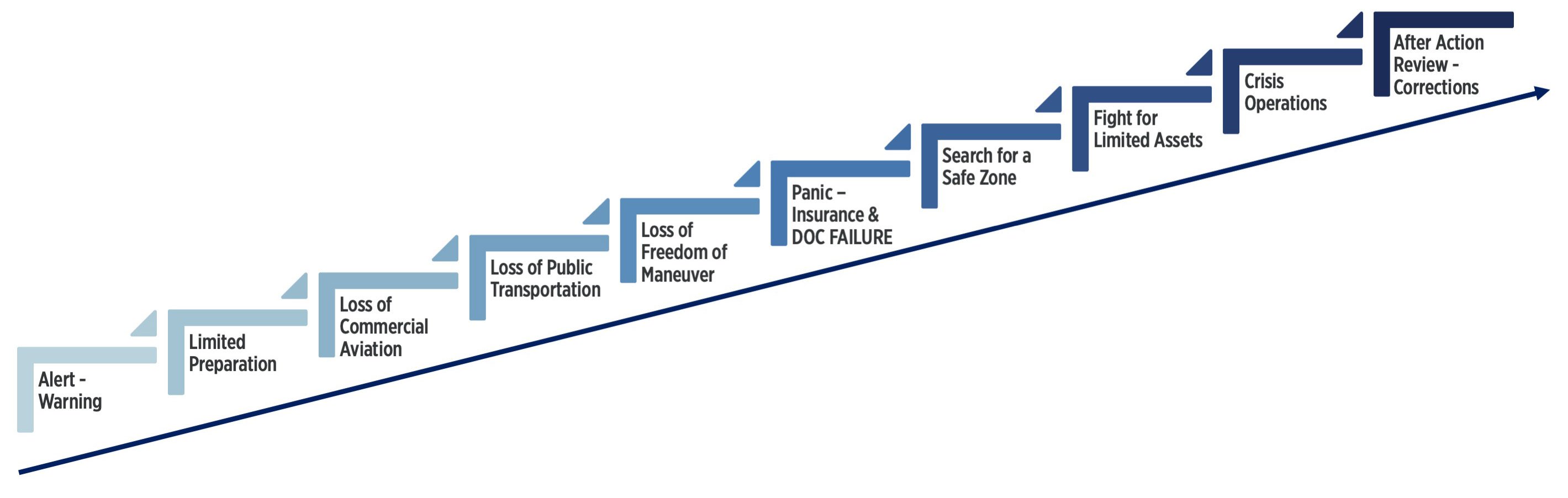

Buckner presented a template for a typical crisis, but said most companies fail to respond adequately due to:

Buckner presented a template for a typical crisis, but said most companies fail to respond adequately due to:

- a lack of understanding of the real world,

- limited understanding of what insurance plans cover,

- a failure to understand the duty of care provider contract,

- a lack of planning, and

- putting the wrong people in charge during a crisis.

During a crisis, Buckner said, there will typically be a loss of an ability to communicate. “You have to assume you are not going to have the internet, text, cellular connectivity once there is a terrorist attack, a natural disaster, or a war,” he said. Further, he added, there will be a disruption of commercial aviation, public transportation, and freedom of movement due to congestion of roads, borders, and seaports. This leads to panic as corporate leaders realize their insurance providers do not cover wars, pandemics, or natural disasters. “When COVID hit, we were stunned at how many people were surprised that they were not covered,” Buckner recalled. “People are not reading their policies in detail, and it comes back to bite you.”

Once they realize they are pretty much on their own, people stranded in a crisis frantically seek a safe zone, but there are very few modes of transport to get there. “You’re left with a very small number of assets and the demand skyrockets,” said Buckner, “so unless you have those [assets] pre-positioned, you are already behind.”

Despite going through experiences of this kind, most companies only do a cursory after action and fail to address the shortcomings of their platforms, said Buckner. “Most firms that failed in Ukraine, failed to understand what their coverage was, they failed to understand what their duty of care provider would or would not do in a warzone, and they failed to have actionable information on their people,” he said, adding that getting this information is difficult if it is not done within the first 30 days of a crisis.

Corporate leaders should understand what duty of care, insurance providers, and emergency responders can do for them in a crisis, but, equally important, what they do not do, said Buckner. “If you understand that, then you can fill in those voids,” he added.

STANDING BY TO SUPPORT

The Global Guardian team is standing by to support your security requirements. To learn more about our Duty of Care Membership and comprehensive security services, complete the form below or call us at + 1 (703) 566-9463.